What is a stock option?

Stock options are a form of equity compensation that allows an employee to buy a specific number of shares at a pre-set price. Many startups, private companies, and corporations will include them as part of a compensation plan for prospective employees. Companies often offer stock options as part of your compensation package so you can share in the company’s success.

Stock options aren’t actual shares of stock—they’re the right to buy a set number of company shares at a fixed price, usually called a grant price, strike price, or exercise price. Because your purchase price stays the same, if the value of the stock goes up, you could make money on the difference. The hope is you get to sell your purchased shares for more than you paid for them. However, you’re never required to exercise—that’s why they’re called options.

What are the different types of stock options?

There are two types of stock options: incentive stock options (ISO) and non-qualified stock options (NSO). These mainly differ by how and when they’re taxed.

ISOs could qualify for special tax treatment.

With NSOs, you usually have to pay taxes both when you exercise and sell. ISOs qualify for special tax treatment if you hold onto your shares for the required amount of time (at least one year after exercising and two years after your grant date), and you may only have to pay taxes when you sell your shares. However, you could have to pay the alternative minimum tax (AMT) if you don’t sell your shares in the same year you exercise them.

Instead of stock options, some companies offer alternative equity awards, such as restricted stock awards (RSA) or restricted stock units (RSU). These types of equity awards are not the same as stock options, and are treated differently for tax purposes.

What is a stock option grant?

Stock option grants are how your company awards stock options. This document usually includes details about:

-

The type of stock options you’ll receive (ISOs or NSOs)

-

The number of shares you can purchase

-

Your strike price

-

Your vesting schedule

Your stock option grant should also specify its expiration date. In general, ISOs expire 10 years from the date you’re granted them. However, your option grant can also expire after you leave the company—you may only have a short window of time to exercise your stock options (buy the shares) after you leave. If you don’t exercise your stock options before then, you’ll lose the opportunity to purchase them.

Ask your company if you didn’t receive a stock option grant. If you just joined in the last month or two, it’s possible that the board has not yet approved your stock options, in which case you should receive the grant shortly after the next board meeting.

Remember: If you hope to purchase and sell your stock someday, accepting your stock option grant is the first step you have to take. It doesn’t cost anything to accept the grant, and you’re not obligated to actually exercise your options. By accepting it, you’re simply giving yourself the opportunity to exercise in the future.

If your company uses Carta to issue stock options, you won’t receive a paper version of your stock option grant. Instead, simply log into your portfolio to view, accept, and print the actual agreement.

How do stock options vest?

Vesting is the process of earning something over time. Companies use vesting to encourage you to stay with them and contribute to the company’s success over many years.

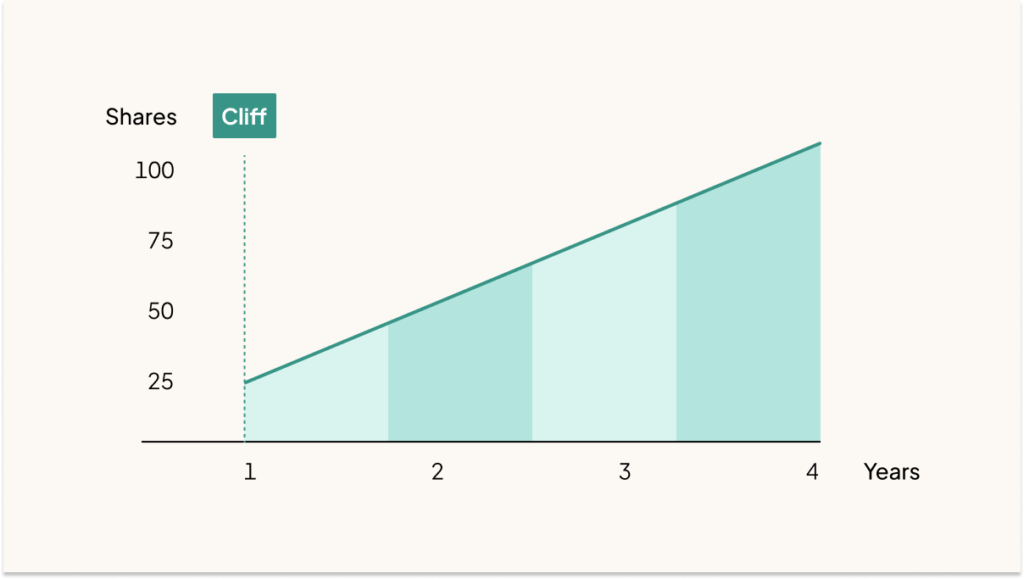

Vesting schedules

Vesting typically occurs on a time-based schedule outlined in the stock option agreement. The vesting start date should be listed on your option agreement. Many companies have a vesting schedule that is four years long, often beginning with a standard one-year “cliff.” A cliff is a period of time that has to elapse before you get any of your vested options.

For example, Meetly is a company that offers options on a four-year vesting schedule with a one year cliff. At Meetly, the vesting start date is the employee’s first day of work. If you take a job at Meetly that includes an award of 100 stock options, you’ll start the vesting clock on your first day of work—but you won’t get your first tranche of 25 options until your one-year work anniversary. After that, you’ll have the option to buy 25 shares. The rest of your options will continue vesting monthly according to the vesting schedule.

Without the cliff, you could accept the offer, work at Meetly for a month, buy a bunch of the company’s stock, and then quit. An option grant that includes a cliff prevents that.

How do stock options work after termination?

If you leave the company, your stock options will most likely stop vesting immediately, and you may only have the right to purchase those options that have vested as of the date you leave the company. You only maintain your option rights for a set window of time after termination, called a post-termination exercise period (PTEP). Historically, many companies used a standard PTEP of three months or 90 days. However, some companies offer more generous PTEPs now. At Carta, for example, you have as long as you worked at the company to buy your shares.

Don’t forget about this window of eligibility. Your company isn’t obligated to remind you when you leave — they usually only tell you in your option grant when you first join.

How do LLCs handle equity?

Limited liability companies (LLC), a different business structure than corporations, also grant equity ownership, but they do not issue stock options. Instead they may issue:

-

Profits interest units (PIU) entitle the holder to a share of the value an LLC gains over time based on its valuation, or liquidation threshold, at the time the PIUs are granted. In this way PIUs are similar to stock grants, in that the recipient does not have to pay for them and they may see a profit if the company grows in value over time.

-

Membership units, sometimes called capital interests, are typically granted to limited partners (LP) who make small direct investments. These units are similar to common shares in C-corporations.

-

Phantom equity grants are cash bonuses to employees and advisers that typically pay out when a company is sold.

There are significant tax differences between LLC equity ownership and corporate shares.

→ Learn more about LLCs vs Corporations.

Knowing what stock options are and how they work can help you make more informed decisions about when to sign your option grant, when to exercise your options, and what to do when you leave your company.